The intersection of distinct human investment philosophies and the analytical power of AI presents a fascinating area for exploration. What happens when different, sometimes conflicting, legendary investment strategies are implemented by AI agents within the same simulated market environment? Gekko is a project designed to explore exactly that.

The Concept: Simulating Investment Minds

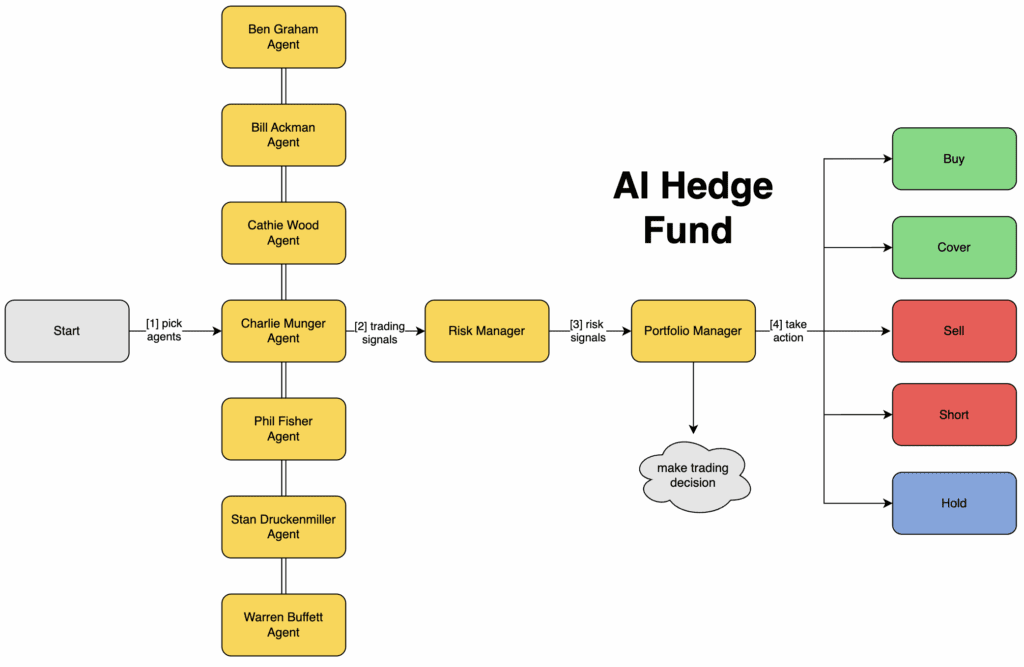

The core idea behind Gekko is to build a platform where AI agents, each modeled after the distinct philosophy of a well-known investor (like Warren Buffett, Cathie Wood, Ben Graham, etc.), can analyze market data and generate trading signals. It serves as a digital sandbox for experimenting with how these AI-driven strategies might interact and perform within a simulated hedge fund structure.

This isn’t about creating a live trading bot. Gekko is intended purely as an experimental and educational tool to observe how LLMs can interpret financial data and mimic strategic decision-making based on predefined investment personas.

Gekko’s Features

To achieve this simulation, Gekko incorporates several components:

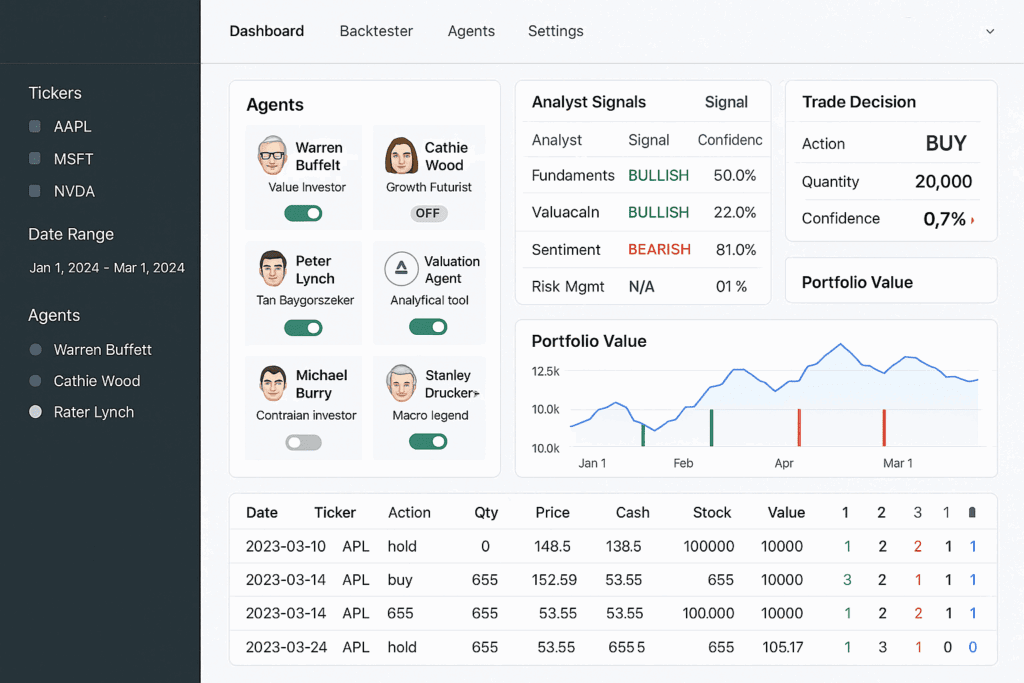

- Diverse AI Agents: A variety of agents represent different investment styles – value, growth, innovation, contrarian, technical analysis, sentiment analysis, and more.

- Multi-Agent System: Agents process data and generate signals; these are then synthesized by portfolio and risk management layers to make simulated portfolio adjustments.

- LLM Integration: Agents utilize Large Language Models (supporting OpenAI, Groq, and local Ollama instances) for data interpretation and reasoning.

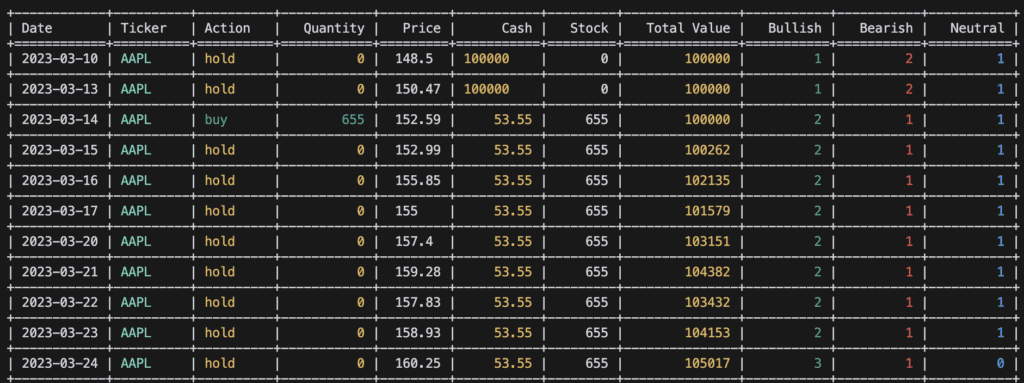

- Simulation & Backtesting: The platform includes a simulated trading engine and backtesting features to run strategies against historical data.

- Dashboard Interface: A ReactJS frontend provides visualization of the simulated portfolio, trades, and agent outputs.

- Reasoning Output: An option exists (

--show-reasoning) to inspect the logic behind agent decisions, aiding in understanding the simulation.

Technical Aspects and Challenges

Developing Gekko involved several technical considerations. Key tasks included:

- Translating nuanced investment philosophies into effective prompts for the AI agents.

- Integrating various data sources (pricing, news, financials) via APIs for agent use.

- Building a backend (using FastAPI) and simulation engine capable of handling the workflow.

- Enabling flexible deployment through Docker.

Seeing how the different agent types process the same information and arrive at varied conclusions based on their programmed personas is one of the core outcomes of the simulation.

Future Directions

As an experimental platform, Gekko could potentially evolve. Further development might involve refining agent interactions, incorporating more sophisticated market data, or enhancing the simulation’s realism. It serves as a base for exploring AI applications in strategy analysis.

Explore and Experiment (Responsibly!)

Gekko is available for those interested in experimenting with AI in the context of financial strategy simulation.